Contract Packaging Market Size, Regional Share (NA/EU/APAC/LA/MEA) and Competitive Analysis

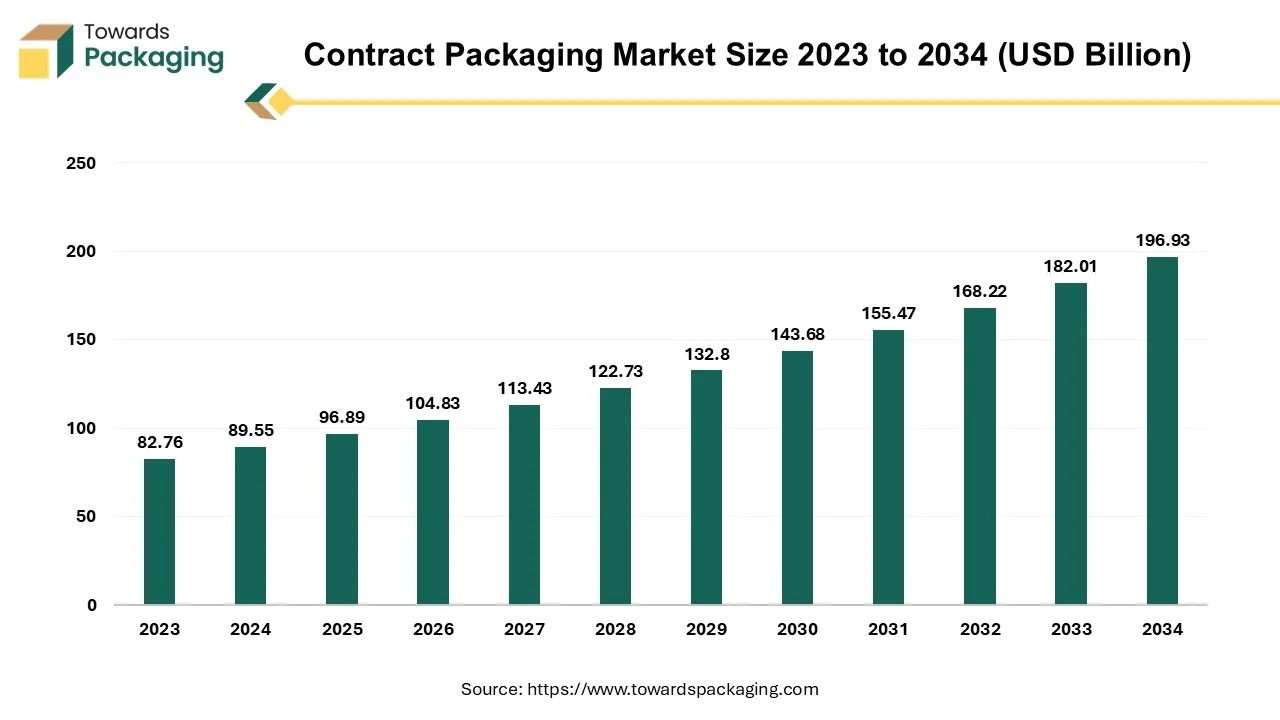

According to Towards Packaging consultants, the global contract packaging market is projected to reach approximately USD 196.93 billion by 2034, increasing from USD 96.89 billion in 2025, at a CAGR of 8.2% during the forecast period 2025 to 2034.

Ottawa, Nov. 04, 2025 (GLOBE NEWSWIRE) -- The global contract packaging market size was recorded at USD 96.89 billion in 2025 and is forecast to increase to USD 196.93 billion in 2034, as per findings from a study published by Towards Packaging, a sister firm of Precedence Research.

It enables businesses to focus on their core competencies while benefiting from operational efficiency, specialized expertise, and cost savings. It allows companies to access advanced packaging technology, also meet complex regulatory requirements, along scale their packaging operations more flexibly and even efficiently than by doing it all in-house.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by Contract Packaging?

Contract packaging is when a firm hires a third-party specialist, or even a contract packager, to manage its product packaging needs. This can include a broad range of services, like design, assembly, labeling, and even distribution, enabling the original firm to focus on core business activities. Moreover, companies are increasingly outsourcing packaging to specialized third parties to reduce expenses and gain efficiency, allowing them to concentrate on their primary business activities. Innovations in technology, like automation, AI, and even smart packaging (like those with sensors for handling temperature and conditions), are enhancing efficiency and permitting new packaging capabilities.

What are the Major Government Initiatives in the Contract Packaging Industry?

- Extended Producer Responsibility (EPR) Schemes: These regulations require manufacturers and brand owners to manage the entire lifecycle of their packaging, promoting the use of recyclable, reusable, and biodegradable materials.

- Single-Use Plastic Bans: Governments in many regions have implemented bans or restrictions on single-use plastics, driving the industry to explore and invest in sustainable alternatives such as plant-based materials and paper.

- Support for Small and Medium-sized Enterprises (SMEs): Programs like India's "Make in India" campaign and export promotion missions provide support, including affordable credit and market access, which indirectly boosts the contract packaging market by fostering SME growth.

- Food Safety and Labeling Regulations: Authorities such as India's FSSAI and other national bodies mandate strict requirements for food packaging materials and labeling, ensuring consumer safety and informed choices.

-

Smart Packaging Regulations and Traceability: Initiatives and regulations, such as new traceability rules, are encouraging the integration of smart technologies like QR codes and other digital identifiers for better consumer information and supply chain transparency.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5167

Key Market Trends:

- Increased use of Automation and Smart Technologies: Due to a need for greater efficiency, reduced expenses, and enhanced accuracy, especially in high-growth sectors such as e-commerce and pharmaceuticals. Automation streamlines repetitive tasks, while smart technologies such as AI and IoT offer real-time monitoring, data analysis, and even predictive maintenance to decrease errors, waste, and downtime, allowing firms to meet user expectations for faster turnarounds, customization, and sustainability. Automation and smart analytics assist in minimizing material and product waste, leading to both cost savings and even sustainability efforts. Smart technologies utilize AI and IoT to predict equipment failures, enabling for maintenance to be scheduled before breakdowns occur, which decreases costly downtime.

- Sustainability and Eco-Friendly Practices: Driven by consumer demand and government regulations, there is a significant shift towards using recyclable, biodegradable, and plant-based materials. Contract packagers are developing innovative solutions, such as mono-material pouches and reusable systems, to reduce the overall environmental impact.

- E-commerce-Driven Innovations: The rise of online retail has created a demand for specialized packaging solutions designed for direct shipping. These include durable, lightweight, and right-sized designs that ensure product safety during transit, reduce shipping costs, and provide an enhanced unboxing experience for the end consumer.

- Customization and Personalization: Brands are seeking highly tailored packaging to differentiate their products in a crowded market and meet consumer preferences for unique experiences. Contract packagers offer the flexibility to manage an explosion of different Stock Keeping Units (SKUs) and produce personalized, seasonal, or limited-edition runs efficiently.

What Potentiates the Growth of the Contract Packaging Market?

Increasing Trend of Outsourcing Packaging Functions

It enables companies to decrease costs, target on core competencies, and gain access to technology, specialized expertise, and flexibility. By offloading non-core but essential functions such as packaging, businesses can concentrate their resources and even efforts on strategic activities like research and development (R&D), product development, marketing, and sales.

Limitations & Challenges

Several significant limitations and challenges are mainly centered on supply chain volatility, cost pressures, labor issues, strict regulatory demands, and the demand to constantly adapt to changing user preferences for sustainability and customization. The industry tackles a persistent lack of skilled labor, from machine operators to technicians. This can contribute to increased operational expenses, production delays, and inconsistencies in performance. Integrating automation and even upskilling staff to work with new technologies is an important, but challenging, response.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Regional Analysis

Who is the Leader in the Contract Packaging Market?

Asia Pacific leads the market because it involves a large and growing production base, significant e-commerce expansion, lower labor costs, and even substantial consumer need from diverse industries such as food and beverage, electronics, and pharmaceuticals. Specific industries, like pharmaceuticals, food and beverage, and electronics, are major drivers of expansion. The pharmaceutical sector, mainly, has seen a significant rise in need for packaging services due to growing health awareness and even the region's role as a global pharmaceutical manufacturing hub.

China Market Trends

Key trends in China's market include high growth boosted by e-commerce and even a burgeoning middle class, increased need for sustainable and customizable alternatives, and strong growth in the pharmaceutical sector. The market is also benefiting from producers outsourcing packaging to reduce costs and target on core business activities.

Japan Market Trends

Significant trends are the rising use of sustainable materials such as paper and flexible packaging, advancements in smart and even automated packaging, and the overall growth in e-commerce, which boosts requirement for both industrial and consumer-facing packaging. Japan's strict regulatory environment, mainly for pharmaceuticals, makes compliance a vital and cost-intensive factor for contract packaging providers.

How is the Opportunistic Rise of North America in the Contract Packaging Industry?

Companies across numerous industries (food and beverage, pharmaceuticals, and personal care) are increasingly outsourcing packaging operations to focus on core competencies, minimize expenses, and enhance operational efficiency. North America hosts the headquarters and even significant operations of various global brands. These large firms usually have complex, high-volume, or specialized packaging demands that contract packagers are well-equipped to handle.

U.S. Market Trends

Key trends in the U.S. market include the continued expansion of the pharmaceutical and food/beverage sectors, a rising focus on sustainability via the use of recyclable materials, and even the adoption of new technologies such as AI to improve efficiency.

Canada Market Trends

Key trends in Canada's market include a growing need for sustainable and eco-friendly alternatives, the integration of technology such as AI and robotics for efficiency, and a rise in e-commerce-related services. There is a remarkable shift towards sustainable packaging, with a growing need for biodegradable and recyclable materials to meet environmental policies, together with consumer preferences. Thus, paper and paperboard are gaining popularity as they are easier to recycle, along innovations are improving their durability and moisture resistance.

More Insights of Towards Packaging:

- Water Soluble Films Market Size, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Nanotechnology Packaging Market Size, Share, Trends, Segmentation, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, and Forecast 2025-2034

- FMCG Packaging Market Size, Share, Trends, Segments, and Forecast 2025-2034

- Connected Packaging Market Size, Segmentation, Regional Outlook, and Competitive Landscape, 2025-2034

- Bulk Container Packaging Market Size, Segments and Regional Outlook 2025–2034

- Pharmaceutical Contract Packaging Market Size, Share, Trends, and Global Forecast 2024–2034

- Returnable Glass Bottles Market Size, Share, Segments, Regional Insights (NA, EU, APAC, LA, MEA), Key Companies, and Competitive Landscape 2025-2034

- Polyethylene Films Market Size (2025-2034), Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Companies, Competitive & Value Chain Analysis, Trade and Supplier Data

- Packaging Printing Market Size, Segment Data, Regional Outlook (NA, EU, APAC, LA, MEA), Company Profiles, Competitive Analysis, Value Chain & Trade/Manufacturer Data, 2024-2034

- Skin Packaging Market Size, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Companies & Competitive Landscape 2024-2034

- Biopharmaceuticals Packaging Market Size, Segments, and Regional Outlook 2025–2034: Competitive Landscape, Value Chain, and Trade Dynamics

- Carton Packaging Market Size, Segmentation, Regional Insights (NA, EU, APAC, LA, MEA), and Competitive Landscape 2025-2034

- Bottled Water Packaging Market Size, Share, Trends, Segments, Regional Insights, and Competitive Landscape, 2025-2034

- Industrial Packaging Market Size, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Companies, Competitive Analysis, Value Chain & Trade Data, Manufacturers & Suppliers

Segment Outlook

Material Insights

Why did the Plastic Segment Dominate the Contract Packaging Market in 2024?

This is due to its versatility, cost-effectiveness, and even excellent protective properties. Plastic is adaptable to a broad range of shapes and sizes, making it ideal for numerous products, while its light weight and durability decrease shipping costs. Plastic is durable and provides excellent barrier properties, protecting goods from external elements such as moisture and oxygen, which helps maintain quality and shelf life.

The paper & paperboard segment is the fastest-growing in the market, due to increasing need for sustainable packaging, expense in e-commerce, and supportive government regulations. Consumers are requiring eco-friendly alternatives, while regulations are restricting single-use plastics, creating paper a preferred substitute. The growth in online shopping has also raised the demand for durable, lightweight, and even affordable paperboard packaging for shipping. New coatings, like slip and barrier coatings, have enhanced paperboard's resistance to moisture and even grease, expanding its usage into new sectors such as frozen foods and personal care.

Packaging Insights

Why did the Primary Packaging Segment dominate the Contract Packaging Market in 2024?

It is essential for product integrity and even directly contacts the product, demanding strict quality and regulatory compliance. The expansion of industries such as pharmaceuticals, with increasing need for specialized solutions like ampoules, sterile vials, and pre-fillable inhalers, has fueled the requirement for primary contract packaging.

The secondary packaging segment is the fastest-growing in the market, due to its dual role in product protection and even marketing. Key drivers involve its function as a robust protective layer during shipping and even handling, its importance as a marketing along branding tool for retail display, and the rising need for specialized packaging in sectors such as pharmaceuticals for kitting and even patient instructions.

There is a growing need for kitting, in which secondary packaging holds additional items like instructions, swabs, and extra needles to fund patient self-administration and compliance. This is vital for complex treatments, like prefilled syringes, and helps enhance patient experience and safety.

End User Insights

Why did the Food & Beverage Segment Dominates the Contract Packaging Market in 2024?

This is due to its large product variety, the demand for specialized and even efficient packaging, and the increasing need for convenience, private label, along with e-commerce-ready products. Contract packaging permits food and beverage firms to leverage specialized expertise along with economies of scale without the high capital expenses of building and maintaining their own packaging facilities.

The pharmaceutical segment is the fastest-growing in the market, due to the rising complexity of drug formulations such as biologics and personalized medicines, the growth of stringent global regulations, and even a strong need for specialized, high-tech packaging solutions. Pharmaceutical firms outsource packaging to decrease operational expenses and aim their resources on research and development and manufacturing. Contract packagers offer flexibility in production scaling and even cost-effective solutions, which can reduce overall costs.

Services Insights

Why did the Bottling and Filling Segment dominate the Contract Packaging Market in 2024?

This is due to its high-volume output and the critical demand for specialized equipment to handle numerous products such as beverages and pharmaceuticals. This supremacy is driven by cost-efficiency together with scalability for brands, as outsourcing enables them to leverage economies of scale as well as specialized technology without significant capital investment. Businesses can now easily scale their production up or down by aligning with a contract manufacturer, providing flexibility that is challenging to achieve with internal resources alone.

The boxing and cartoning segment is the fastest-growing in the market, due to the explosive expansion of the e-commerce sector, the drive for sustainability, as well as the rising adoption of automation. Consumers, along with governments, are increasingly needing environmentally friendly packaging alternatives. Paper and paperboard, the main materials in boxing and even cartoning, are highly recyclable and biodegradable, working perfectly with sustainability goals and offering a viable alternative to plastics.

Recent Breakthroughs in the Global Contract Packaging Industry:

- In November 2024, Amcor Plc, a Switzerland-based company, announced buying the U.S. peer berry global for $8.43 billion in an all-stock deal. This agreement created a consumer and healthcare packaging gaint with a combination of revenue of $24 billion.

- In December 2024, Nobolex, an Apollo-backed company, announced the purchase of Pactiv Evergreen for $3.33 billion. This deal was valued at $6.7 billion including debt ans was sslated to close in mind-2025.

- In October 2023, Sharp, a worldwide leader in commercial pharmaceutical packaging and even clinical trial supply services, declared the acquisition of Berkshire Sterile Manufacturing (BSM). BSM is a Massachusetts-driven fill-finish Contract Development along with Manufacturing Organization (CDMO) for clinical and even commercial sterile injectable products.

Top Companies in the Contract Packaging Market & Their Offering

- Aaron Thomas Company: Specializes in high-speed, automated turnkey contract packaging and fulfillment solutions, with expertise in food, nutritional supplements, and club store packaging.

- Unicep Packaging: Offers specialty contract manufacturing and filling of liquids, gels, and creams into innovative single-use, precision-dosing packaging, primarily for the healthcare and personal care markets.

- Green Packaging Asia (GPA Global): Provides sustainable and eco-friendly packaging strategies and materials, including options made from recycled paper, sugarcane bagasse, and bamboo, with a focus on reducing environmental impact.

- Multi-Pack Solutions LLC: Delivers comprehensive contract manufacturing and packaging services, including blending, bottle filling, tube filling, sachets, and wet wipes manufacturing for consumer, medical, and industrial brands.

- Reed Lane: Specializes in pharmaceutical contract packaging, offering services such as blistering, bottling, pouching, and kitting while maintaining strict regulatory compliance for medical products.

- CCL Industries: Is a global specialty packaging company that provides a wide range of innovative solutions, including labels, security, and consumer packaging, to major corporations in various industries like healthcare and personal care.

- Stamar Packaging Inc: Offers diverse contract packaging and fulfillment services, including blister packaging, shrink wrapping, and kitting, serving industries such as medical, industrial, and consumer goods.

- Sharp Corporation (Sharp Packaging Solutions): Provides contract packaging services specifically for the pharmaceutical and clinical trial industries, focusing on blistering, bottling, soft gels, and specialized kitting with high regulatory standards.

- DHL: Offers green packaging solutions and logistics advice as part of its broader supply chain and shipping services, focusing on sustainable practices and optimized transport packaging.

- Wepackit Inc.: Provides a variety of contract packaging and fulfillment services, including kitting, assembly, overwrapping, and private labeling, with a focus on efficiency and customer service.

- Kelly Products: Offers contract packaging and manufacturing services primarily for the agricultural, automotive, and household chemical industries, specializing in liquid and chemical blending and packaging.

- Sonic Packaging: Specializes in unit dose and innovative packaging solutions, including single-use pouches, stick packs, and blister packs, for the cosmetic, personal care, and pharmaceutical industries.

-

Genco (FedEx Supply Chain): As part of FedEx Supply Chain, Genco offers comprehensive logistics, fulfillment, and contract packaging services that integrate with their extensive distribution network.

Segments Covered in the Report

By Material

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Aluminium

By Packaging

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

By End User

- Food & Beverage

- Pharmaceutical

- Cosmetic & Personal Care

- Household

- Industrial

- Chemicals

- Electronics

By Services

- Bottling and Filling

- Bagging/Pouching

- Lot/Batch and Date Coding

- Boxing and Cartoning

- Wrapping and Bundling

- Labelling

- Clamshells and Blisters

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5167

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight - Check It Out:

- Electronic Packaging Market Size, Share, Trends, Regional Insights, Competitive Landscape

- Medical Device Packaging Market Size, Segments, Regional Outlook

- Virgin Plastic Packaging Market Size, Share, Regional Insights, Segments

- Beer Packaging Market Segments, Regional Outlook (NA, EU, APAC, LA, MEA)

- Retort Packaging Market Size, Share, Trends, Segments, and Regional Insights

- Insulated Packaging Market Size, Segments, Companies, Competitive Analysis

- Foam Packaging Market Size, Share, Trends, Segments, Regional Insights

- PTFE Tapes and Films Market Size, Segments, Companies, Competitive Analysis

- Cell Therapy Packaging Market Size, Segments, Regional Data, and Competitive Landscape

- 3D CAD Software Market Growth, Key Segments, and Regional Dynamics

- Paper and Paperboard Packaging Market Size, Segments, and Regional Analysis

- Plastic Food Packaging Market Size, Segments, and Regional Analysis

- Packaging Market Size, Segments Data, Regional Analysis

- Secondary Packaging Market Size, Growth Forecast, and Key Segments

-

Packaging Automation Market Size, Segmentation, Regional Insights

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.