Midland Property Tax Appeals Save Taxpayers Over $72 Million in Value

O'Connor discusses how Midland property tax appeals saved taxpayers over $72 million in value.

MIDLAND, TX, UNITED STATES, November 4, 2025 /EINPresswire.com/ --Texas is stereotypically thought of as being built on oil and cattle. While this is certainly not true for much of the state, the riches of petroleum have largely been responsible for making Midland County what it is today. Boasting some of the highest salaries in the state, the city of Midland and the surrounding area has seen a boom in construction in recent years, for both homes and businesses. This has helped diversify a growing economy, though oil and gas are still king and queen. This wealth has driven real estate into higher demand than has ever been experienced in the region, which has led to an explosion in property values and taxes.

Midland County has an underserved reputation as an expensive place to live, but overaggressive assessments from the Midland Central Appraisal District (MCAD) have certainly fueled the rumors. While exemptions help, the primary way to protect all types of property is with tax appeals. These have been finding a lot of success in Midland County in recent years and continue to grow in popularity as values increase. Both informal appeals and formal hearing with the appraisal review board (ARB) have now concluded, so the efficacy of these administrative protests can now be judged. In this article, we will explore how appeals were able to deal with rising values.

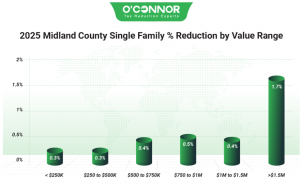

Midland Homes Save 0.4% With Informal and Formal Appeals

According to MCAD, 43% of homes were overvalued in 2024, while 22% were overvalued in 2025. Overall, home values increased 1.3% in 2025. Thanks to a combination of informal and formal appeals, this was eventually cut 0.4% to $16.80 billion. Homes between $250,000 and $500,000 were the largest source of value, falling 0.3% to $8.09 billion. Homes under $250,000 were likewise reduced by 0.3%, for a new total of $3.28 billion. Residences worth between $500,000 and $750,000 reached $2.86 billion after a decrease of 0.4%. The largest homes got the largest reduction, with a drop of 1.7% being obtained by homes worth over $1.5 million. These luxury homes totaled $617.42 million. Homeowners that chose O’Connor saved 0.7% overall, including 1.4% for homes assessed from $750,000 to $1 million.

When viewed by size, home values followed nearly the same trend. Residences under 2,000 square feet and those between 2,000 and 3,999 square feet each saw a decline of 0.3%. These totaled $5.90 billion and $8.65 billion respectively. Homes measured from 4,000 to 5,999 square feet experienced a reduction of 0.6%, achieving a total of $1.57 billion. Luxury homes between 6,000 and 7,999 square feet dropped 0.5%, while mansions over 8,000 square feet were cut by 1.6% thanks to appeals. These had final sums of $410.30 million and $175.37 million respectively.

When it comes to age of construction, Midland County homes are quite spread out, which is unusual for Texas. Following a small reduction of 0.2%, homes built between 2001 and 2020 totaled $6 billion. $3.70 billion was generated from homes constructed from 1981 to 2000, while $2.51 billion came from those constructed from 1961 to 1980. These decreased by 0.4% and 0.3% respectively. Homes older than 1960 contributed an impressive $2.90 billion to the total after a cut of 0.2%. New construction added the most value initially, topping 9.6%, but was reduced with appeals by 1.2%. The total for new homes was $1.67 billion.

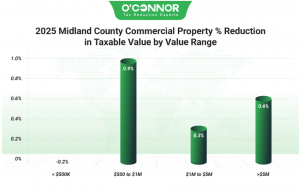

Commercial Properties Fall $10 Million in Taxable Value

Commercial properties added 7.3% to their taxable value in 2025. This does not include the oil and gas industry directly, or both the increase and the total would have been much higher. This left a total of $2.76 billion. Thanks to constant appeals, this was later pushed down by 0.4% to $2.75 billion. Commercial properties worth over $5 million were in second place for value, contributing $779.78 million following a solid reduction of 0.6%. Those worth between $1 million and $5 million experienced a cut of 0.3% and took first place with a total taxable value of $848.64 million. Businesses between $500,000 and $1 million received the largest reduction at 0.9%, reaching $426.77 million. Small businesses did not see any meaningful reductions, seeing a final total of $602.23 million.

Raw land was the No.1 commercial property type, with a total of $955.71 million after a reduction of 0.1%. During the 2025 assessment, this was one of the few categories that added value, as many saw strong retreats in value. Offices were slashed 3.4% thanks to appeals, dropping to $822.12 million. Warehouses experienced a reduction of 1.6%, achieving a new total of $834.75 million. Apartments only totaled $55.59 million, an unusual situation in Texas. They saw a 7% decline in the assessment period, but were adjusted back up, resulting in a gain of 28%. Retail also had a small footprint of $27.21 million following a solid reduction of 3.9%.

Unlike homes, commercial property was mostly confined to two areas. 43.5% of value came from businesses built between 2001 and 2020, while raw land was responsible for 36.8% of value. These totaled $1.20 billion and $1.01 billion respectively, with construction from 2001 to 2020 dropping 1.4%. Properties from 1961 to 1980 and those from 1981 to 2000 did not see any reductions of note, though they had previously seen a decline in value during the assessment. New construction added 14.6% in value, before dropping 3.4% to $260.73 million.

Offices Save 3.4% with Combined Appeals

When it comes to Midland County commercial properties, offices were in third place behind raw land and warehouses. Initially valued at $851 million, these important buildings were cut 3.4% to $822.12 million. Recent construction weighed heavily on offices, with over 71% of value being built between 2001 and 2025. $487.09 million came from offices constructed between 2001 and 2020, while new construction was responsible for $98.93 million. These two totals were obtained after appeal reductions of 6.1% and 2.5% respectively. Construction from 1981 to 2000 reached $119.42 million, as values rose 5.6%. The oldest offices in the county got a strong reduction of 5.5%. Office owners that used O’Connor managed to save 4% overall, beating the county number of 3.4%.

MCAD divided offices into three categories. Low-rise offices were the largest by far, with $774.49 million in value after a reduction of 3.5%. High-rise offices reached $46.61 million following a cut of 2.2%. Medical offices came in last with $1.09 million, though they got the best reduction with 4%.

Warehouses Decrease Taxable Value by $12 Million

Only raw land was more valuable than warehouses in Midland County. As these typically dovetail from the oil and gas industry, they are usually in a great spot. After appeals reduced the total by 1.6%, the final sum for all warehouses was $834.75 million. The recency bias in construction was incredibly pronounced, with over 95% of all value being built from 2001 to 2025. $637.59 million came from warehouses built between 2001 and 2020, which was after a reduction of 1.1%. New construction saw a cut of 4%, resulting in a final tally of $160.66 million. O’Connor was able to help warehouse owners significantly, reducing the total by 2.5%.

There were only two types of warehouses according to MCAD. Generic warehouses had the lion’s share with $833.28 million following a cut of 1.6%. Office warehouses fell by 2.6% to $1.47 million.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.